The Prepaid Insurance Account Is Increased by Entering a

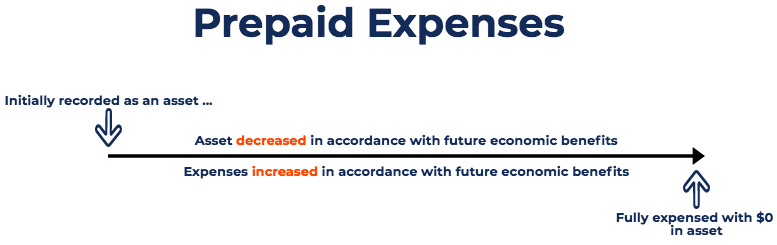

The period for which insurance is prepaid is generally one year but may exceed a. To do this debit your Expense account and credit your Prepaid Expense account.

Prepaid Expenses Examples Accounting For A Prepaid Expense

After all transactions have been recorded foot the accounts where necessary and enter the balances in.

. 1 for 4800 and the Prepaid insurance account was initially increased for the payment. A 12-month insurance policy was purchased on Dec. Increased by a credit.

This is done with an adjusting entry at the end of each accounting period eg. Decreased by a debit. As of November 30 none of the 2400 cost has expired and the entire.

Therefore prepaid insurance must be adjusted. The income statement account Insurance Expense has been increased by the 900 adjusting entry. When a business receives revenue Sales is _____.

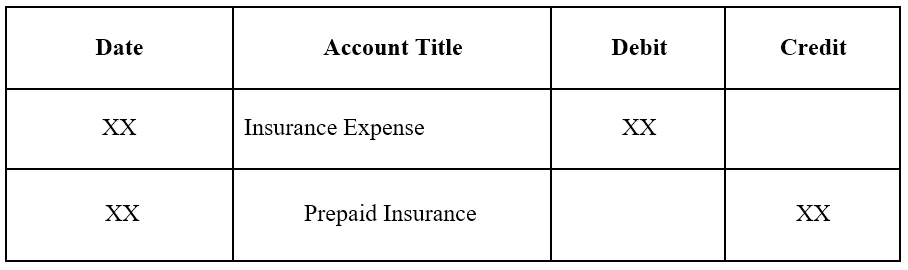

The required adjusting journal entry. In each successive month for the next twelve. Prepaid insurance definition How is prepaid insurance recorded.

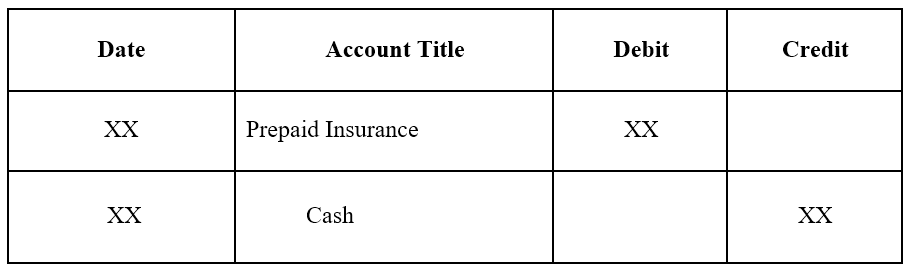

The adjusting journal entry is done each. Answers and explanations Debit prepaid insurance 22000 and credit cash 22000 When a payment is. The required adjusting journal entry on.

At the end of one month Company A would have used up one month of its insurance policy. A 12-month insurance policy was purchased on Dec. The prepaid insurance account.

When a business buys an asset on one date and agress to pay on a later date the tranaction is ____. Owners equity is increased with a 3. At the end of the accounting period create an adjusting entry that amortizes the predetermined amount to the most relevant expense account.

2Owners equity is increased with a _____. 1 for 4800 and the Prepaid insurance account was initially increased for the payment. To recognize prepaid expenses that become actual expenses use adjusting entries.

Once all amortizations have. The accounts payable account is decreased with a 7. Accordingly to increase this account you have more prepaid.

At the end of the month before the books are closed for the month make one double entry to the journal. When a business pays for insurance Prepaid Insurance is _____. Payments that are made in advance for insurance services or coverage.

Credit of 4000 to Prepaid Insurance. On November 20 the payment is entered with a debit of 2400 to Prepaid Insurance and a credit of 2400 to Cash. To enter this in your bookkeeping records you will simply multiply 1500 by three to get a total amount of 4500.

As you use the prepaid item decrease your Prepaid Expense account and increase your actual Expense account. To place an amount on the left-hand side of the T account is to 4. 1An asset account is increased with a _____.

An asset account is increased with a the accoun 2. If the premium were 1200 per year you would enter a credit of. Below is the journal entry for prepaid expenses.

The prepaid insurance account is increased by entering a ___debit_____. The drawing account is decreased by entering a 6. One objective of the adjusting entry is to match the proper amount of insurance.

Beginning balance of Prepaid Insurance is 5000. What is the proper journal entry to record this transaction. According to the three types of accounts in accounting prepaid expense is a personal account.

The prepaid insurance account is increased by entering a 5. The initial entry is a debit of 12000 to the prepaid insurance asset account and a credit of 12000 to the cash asset account. When a business pays cash on account a liability account is _____.

This creates a prepaid expense adjusting entry. Amount to be adjusted Beginning balance -. 3To place an amount on the left-hand side of the T account is to _____ the account.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Prepaid Expenses Examples Accounting For A Prepaid Expense

The Statement Of Cash Flows Is Unmistakably The Most Difficult Of The Financial Statements To Prepare With Three Sec Financial Accounting Accounting Cash Flow

No comments for "The Prepaid Insurance Account Is Increased by Entering a"

Post a Comment